The Bordeaux 2014 en primeur campaign is now in full swing. The Singapore wine dealers are already taking orders as soon as the chateaux in France release their prices. The question for us, consumers in Singapore, is : does it make sense to buy en primeur?

There are a lot of opinions written about the 2014 vintage in the foreign wine press (see for example the good coverage provided by the Decanter magazine). It seems that this is the best vintage since the blockbuster 2010. The main reason to buy en primeur soon after the grapes have been harvested is to purchase the wines in advance with the intention of securing the lowest possible price for the wine and perhaps hope that the price would have risen by the time the wines are bottled and physically released in about two years later (in the case of EP 2014 it will be mid-2017).

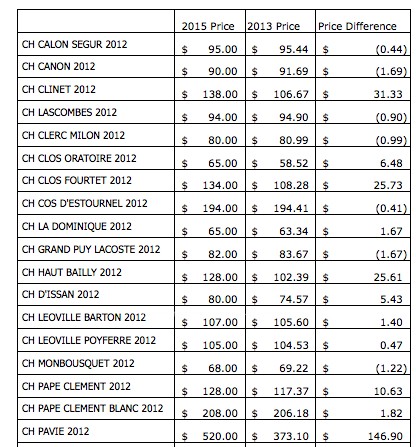

Co-incidentally, the physical wines of vintage 2012 are also now being released. I thought it might be interesting to see how one would have fared if one had bought Bordeaux 2012 en primeur in 2013. I have compared the 2015 retail price (all duties and GST included) with the price on release in 2013. To arrive at the equivalent 2013 retail price I had used the Singapore wine release price plus an estimated $20 (for shipping and duty) and 7% GST – which explains the odd numbers.

The wines selected are totally random (basically the middle part of an alphabetical list) and which my primitive research can locate their equivalent prices back in 2013 from the same Singapore wine shop.

It would appear that most of the prices have remained roughly the same. The obvious over-performer is Chateau Pavie which saw its price rise by almost 40%. They were promoted to the highest level in the Saint Emilion appellation (Premier Grand Cru Classe A) at the end of 2012. The promotion had already been factored into their 2013 release price which was a large increase (around 50% I believe) over the previous year price. The promotion effect seems to have continued to gather momentum since then.

The other notable ones that made some gains of around 25% were Ch Clinet, Ch Clos Fourtet and Ch Haut Bailly. I can only guess that these had increased because of their revised scores from Robert Parker.

The good news appears to be that at least the price have not dropped. It is a question of whether it is worth all the trouble to buy two years in advance. It would seem that wine selection is quite similar to investment in shares. Stock picking is crucial. Even in a not-so-good year like 2012, there are some gems – provided you had picked them correctly. The odds however do not seem very high.

Cheers!

Discover more from The Ordinary Patrons

Subscribe to get the latest posts sent to your email.